|

| Minnesota Fair Tax Propaganda |

There are plenty of Reuters and Associated Press articles covering the problems faced by municipalities like Detroit. To most people though, the issue is whether to bail-out or not. No one talks about budgets and overspending. These people openly criticize the bank bail-outs from 2008 and ask why couldn't Detroit be bailed-out as well. This view is too simplistic. It misses the main issue and ignores that owners of companies like Bear Sterns and Lehman Brothers were wiped out completely. We should therefore understand a little more about governments, budgets and taxes.

There is one great difference between federal budget deficits and those from cities and states. The federal government can inflate it's way out of a deficit. Meanwhile, states and municipalities can't. The federal government, through their exclusive currency printing right, can increase inflation, thus reducing the value of the money they owe. Of course that this means that citizens will lose buying power as incomes fail to keep up with inflation. Moreover, the value of all family savings is also destroyed by inflation. Indirectly, citizens pay the bill.

|

| US Government Spending (1950-2013) |

Tax money comes from direct confiscation of your income. Inflation is a form of indirect confiscation of the same. Both penalize earners and savers while benefiting heavy borrowers.

Out of the two forms of confiscation, inflation is much easier to get approved by voters. They are simply never asked. All the federal government needs to do is print more money, which is often viewed as a good thing for the economy. On the other hand, additional taxes tend to upset voters; which is why the federal government has it so much easier than states or municipalities. Local governments are forced to either raise taxes, which is difficult, or balance their budgets by only spending what their present tax confiscation can afford.

|

| GSA Charge Card |

Imagine the least financially responsible person you know. That is what governments are like. They just don't care about overspending while raising excessive debt. After all, tax payers and not politicians are on the hook for repayment. By the time any problems arise, the bureaucrats who created the shortfalls will be gone. In a way it's a game of musical chairs where the tax payer is the one looses when there are no more chairs left.

These are the exact problems that Detroit faces. For many decades now, the city has publicly promoted the idea that it was business-friendly. But the reality is that the city is anything but friendly.

Disputes between labor unions and city management are legendary. When plans to restore Cobo Center were being discussed, things became ugly. That the site of the world-famous Detroit Auto Show desperately needed repairs faded in relevance as soon as accusations of racism and corruption were voiced by both sides of the negotiation table. One was left wondering if either was really any better than the other. Needless to say, nothing good ever comes out of these encounters.

Elsewhere, there is Wayne State University, a great school situated in the middle of downtown Detroit. If you ever consider sending your kids to this college, you should be aware that it is not uncommon for the school police to have to drive students from their classroom to the school's parking lots soon after dusk. It is that dangerous. Can you imagine if you had to hire security to ensure your employees are fine when they leave work?

|

| Detroit Auto Show |

Without tax payers to cover the debt, the city has to rely on someone else to pay the bill.

A bail out by the federal government would mean that conservative tax payers in states like Nebraska will have to pay the bill.

Right now the state of Michigan has named a city administrator to try to negotiate down the debt to a manageable level. To do this, he is facing anger from many. City employees will see their pensions shortchanged while their salaries take a hair cut. Unions will have to give up previously concession gains. Lenders will lose their money. Only by distributing the pain between all stake holders can the city prevent a bankruptcy that would wipe out all city assets while granting everybody much less. Bankruptcies are ever only good for attorneys.

The challenge is thus difficult. The odds are that tax payers will have to pay. But where will these payer come from is the main question. Without knowing it, you are already carrying a ticket to see who gets to pay. Maybe you get lucky.

Perhaps most disturbing is the fact that Detroit isn't the only city in trouble. There are cities all around the nation facing the same problems. Even within Michigan, several cities have emergency managers in place trying to solve their issues. Moreover, there are even several states facing unsustainable levels of debt.

As if Enron's collapse wasn't enough for all of us to learn, state governments everywhere are cooking their books. They are showing reduced budget shortfalls in their balance sheet. Recently, Moody's analysed the way their pension liabilities are calculated. In their opinion, there is about $1.5 trillion in liabilities that is not being recognized as liabilities.

|

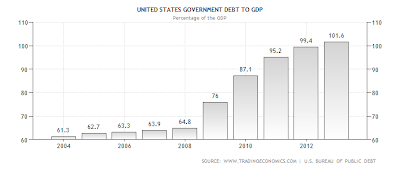

| US Debt to GDP (2004-2013) |

It is a matter of time before taxes will increase. Like with Enron, there are never any problems until there are problems. But you can't wait. Since most taxes today are paid by citizens and not by businesses, politicians wanting to find new places where to confiscate income will aim their attention at businesses; especially now that high unemployment means that consumers have no more money to get. You now understand why the Obama administration has targeted taxes on business and the rich so aggressively. If they wish to continue spending, they really have no other logical alternative.

|

| Halliburton |

Yesterday we talked about the impact that additional taxes could have on marginal businesses, especially during recessionary times. Today, we are seeing the widespread problem of uncontrolled spending at all levels of government. We also saw what can happen when things break, like in the case of Detroit. The fact is that, in the aggregate, the picture is not great.

Is it possible that your taxes could skyrocket? It is almost a certainty that they will. Is it probable that it will happen in the next two years? No; the probability is low today. But relying on the low probability of immediate-harm as a reason to delay finding ways to hedge the risk is unacceptable. Your employees and your own family depend on you making the right decision. I therefore suggest that you look at a way to exploit the tax rate arbitrage between different cities and states. Make the appropriate plans to reduce your risk. It could be a matter of life or death for your business at a time when things are already difficult enough.

No comments:

Post a Comment