|

| Photo by peakoilblues.org |

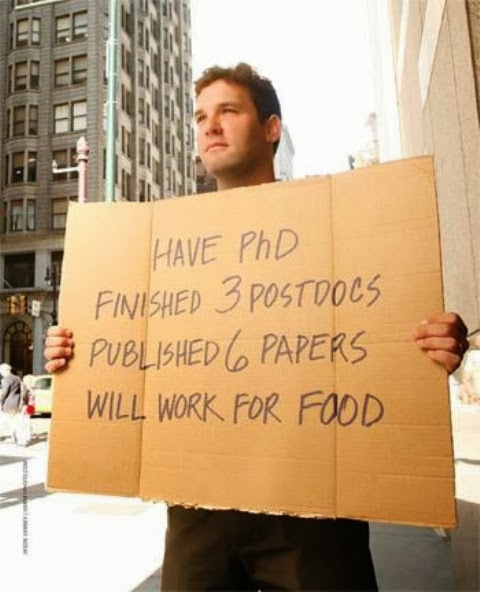

Today, the Jobless Claims report surprised experts with a 348,000 claims headline. Before to the announcement, the expected range was between 330,000 and 345,000. The prior report was adjusted down 2,000 to 334,000; thus making the current report a substantial increase.

Since the report is volatile in nature, it is always best to use a moving average when looking at the data.

So when could we expect confirmation of a failed recovery in jobs? Cycle theory advocates concur that any time in 2014. Their idea is that markets oscillate in a fairly periodic basis and that it is now time for the next swing lower.

Demographers generally agree. Demographers look at the effect that Baby-boomers have on the overall economy.

Just remember that these are not sharp points on a graph but rather a slow turning curve. So, keep an eye on the broad trends.

Look at this morning's Jobless Claims chart.

|

| Jobless Claims data by Haver Analytics |

But if the thesis fails, we should be challenging the top end of the larger trend, which is marked by the channel I drew over the chart. There is a strong chance that in about seven to eight weeks we will test the channel's integrity with the 4 week moving average line. The target is near 350,000 claims.

As we approach the upper channel band, the chart may display a bit of volatility (noise). But soon after, we will know the outcome.

Even if the resulting trend moves sideways at a 350,000 level after breaking above the channel, it would still be a confirmation that the so called recovery in jobs failed.

Why is employment important? Well, because the consumer is a massive portion of the US economy.

Yes, I am geeking out with the technical chart analysis this morning.

02-27-2014 10:14 AM Update:

Consumer Electronics expert Barry Vogel made a very relevant comment in my LinkedIn page:

To my way of thinking, the jobless reports and related reports are a meaningless exercise. When the vast majority of jobs created are minimum wage or near minimum replacing solid middle class jobs, the numbers are meaningless. When people are forced out of the workforce before they wish to retire, the numbers are worthless. When formerly hard working people have given up after failing to find meaningful employment after more than a year, the numbers are an insult. To your point, the economy is far more fragile than anyone cares to admit. I do not believe that we have recovered. The economy could not stand on its own without being propped up by government spending. We are just one major financial blow away from disaster at any time.

This was my response:

You are very correct Barry.

The Unemployment report, which is reported separately, fails to include (1) people with expired benefits and (2) those with part time jobs who would rather have full time employment. But if today's Jobless Claims report increase, as it is now evident, then things would be worse than you have clearly noted. It's a bit of bad on top of bad.

Thanks for the great insight.

No comments:

Post a Comment