|

There is a consumer borrowing

party going on |

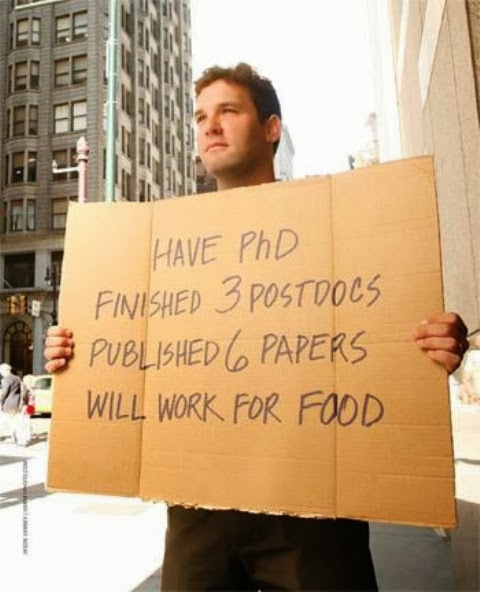

Is the consumer-borrowing party getting louder out of happiness or desperation?

Today, the

Federal Reserve reported that consumer borrowing took a surprisingly large jump of $18.8 billion in December to $3.1 trillion for the year.

Some argue that this is due to the Christmas season. Others claim that it is a good sign that the economy is improving. Both are wrong.

I will remind those who think that the jump is due to Christmas of the fact that 2012 also had one of those. The total last year was $2.9 trillion compared with the $3.1 trillion for 2013. So the substantial increase was not due to the holidays.

With regards to higher borrowing being a sign of confidence, I would say that it is possible but improbable. While spending could be a sign of consumer confidence, I would instead expect to find the initial signs of confidence among employers. But so far I see none.

|

Nonfarm Productivity and Unit Labor Costs

by Haver Analytics |

Employers hire employees when the balance between greed and fear tilts towards greed. Unfortunately, employers are acting with a bias towards fear. Fear makes them behave controlled and measured. On the other hand, greed creates stampedes. Fear drives efficiency up. Greed drives it down. The

efficiency report from this week clearly showed that efficiency is way up. Productivity went up while unit of labor cost went down. Less input to more output equals higher efficiency. Again, this behavior is rather typical of fear periods.

The signs clearly point at a consumer who is using more credit cards not out of optimism but rather out of need. Consumers are rebuilding leverage again, but absent an economic boom this time. People are borrowing the money they don't have. If this assumption is correct, in a few months we will see unsecured-loan defaults rising. So be prepared just in case I am right and the extra spending isn't due to a better economy. In your shoes, I would not hold my breath.

I only wonder what it would take for people to remove the blinders. In 2006 I told anyone who would listen to skip buying a house. I told them all to sell their home instead and to rent one in the mean time. People thought it was a stupid idea.

Today, I see the same about the ineptitude of this White House. Here, Congress is not an excuse because they have always been trouble for any president. The variable this time is a president who has no clue of the social aspects of markets. He either does not understand what makes economies work or refuses to do the right thing. He is either incompetent or unethical; you chose. The fact is that there are not enough jobs being created. We need about 400K new jobs per month instead of the joke of a number we are getting.

The only reason for the low unemployment is the low participation. But here, the President argues that the low participation is due to Baby-boomers not seeking jobs. But this too does not match reality.

If boomers were no longer looking for jobs, there would be an excess of job openings in the jobs they previously held; jobs as managers and sales people. Instead, the lack of employee supply is for welding positions. These were not the jobs that most Baby-boomers had. They were insurance agents, traveling reps, real estate agents. Unfortunately, the real supply imbalance in these areas is one where there are not enough of these jobs for the many job seekers fighting for them. I recently saw a job listing for COO where more than 150 people applied for the one job. What? 150 Chief Operating Officers for just one job? This directly contradicts the assumption that jobs for the educated are plentiful. As someone commented in

CNBC today, unemployment for those with college degrees remains about 4% higher than before the recession. So much for that spin.

In simple terms, the government's claim is just hiding the truth from naive citizens. I say naive because it seems clear to me that they wrongly elected the President because he sounded well while delivering empty speeches. If I had anyone of them read the speeches rather than hear Obama say them, they would think very differently of the message. So, let's just hope that this President does not take us so far into the hole that we can't recover later on.

As for the risk at hand, keep in mind that we already owe more money than any other country in the history of the planet. In a nutshell, your taxes (assuming you pay any) fall way short of what government spends. For every dollar in taxes, we ask the Chinese for 60% in extra loans. Soon they too will realize we just don't have any money.

The facts continue to contradict the White House's spin. While they can attempt to impress us with the best displays of curve-fitting by Nobel Prize economists, the fundamental reality continues to call attention to the fact that consumers are being squeezed, boomers are out of their jobs and employers are scared. Let's demand better leadership.